Getting My Hard Money Atlanta To Work

Table of ContentsWhat Does Hard Money Atlanta Mean?The Greatest Guide To Hard Money AtlantaHard Money Atlanta Can Be Fun For AnyoneNot known Details About Hard Money Atlanta

Considering that hard money fundings are collateral based, additionally recognized as asset-based lendings, they call for marginal documentation as well as permit financiers to shut in an issue of days. These loans come with more risk to the loan provider, as well as as a result call for greater down repayments and also have greater rate of interest rates than a typical loan.Along with the above failure, tough cash loans and conventional home mortgages have other differences that identify them psychological of capitalists and lenders alike: Difficult cash financings are moneyed quicker. Several traditional car loans might take one to two months to shut, but difficult cash finances can be enclosed a few days.

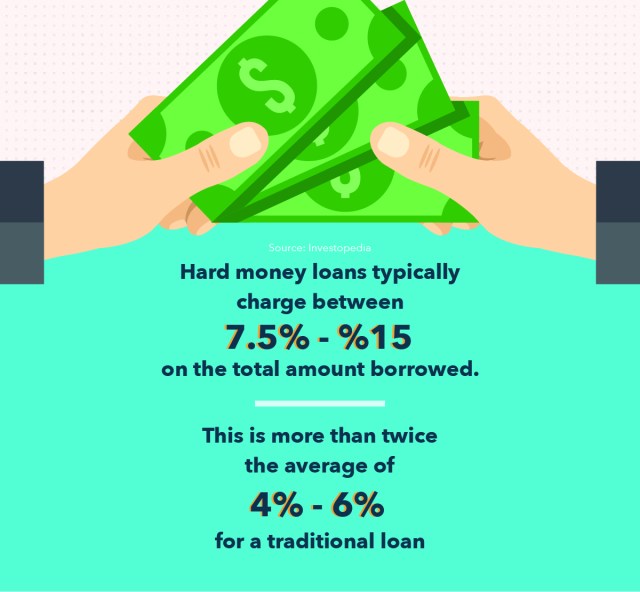

Most hard cash fundings have short repayment durations, generally in between 1-3 years. Standard home loans, in contrast, have 15 or 30-year settlement terms usually. Difficult cash lendings have high-interest rates. Most difficult money financing rate of interest are anywhere in between 9% to 15%, which is dramatically greater than the rates of interest you can anticipate for a conventional home mortgage.

As soon as the term sheet is signed, the car loan will certainly be sent out to handling. During finance processing, the lender will certainly request records and also prepare the car loan for final finance evaluation and also timetable the closing.

Rumored Buzz on Hard Money Atlanta

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

You'll need some capital upfront to certify for a difficult cash financing and also the physical property to serve as security. In enhancement, tough cash financings generally have higher passion prices than traditional mortgages. hard money atlanta.

Common departure methods include: Refinancing Sale of the asset Payment from various other resource There are lots of circumstances where it may be beneficial to use a hard money funding. For beginners, real estate capitalists who like to house turn that is, purchase a run-through house in need of a great deal of work, do the job personally or with service providers to make it better, then reverse and sell it for a greater rate than they bought for may find difficult cash loans to be optimal funding alternatives.

Because of this, they do not require a lengthy term as well as can stay clear of paying as well much passion. If you buy investment residential properties, such as rental residential or commercial properties, you might additionally locate hard money fundings to be good choices.

5 Simple Techniques For Hard Money Atlanta

Sometimes, you can likewise utilize a tough money finance to purchase uninhabited land. This is an excellent alternative for developers who remain in the procedure of receiving a building car loan. hard money atlanta. Note these details that, even in the above scenarios, the possible disadvantages of tough cash financings still apply. You have to make sure you can settle a hard money loan prior to taking it out.

While these types of finances might seem challenging as well as daunting, they are a frequently utilized financing method many real estate capitalists make use of. What are hard cash loans, and exactly how do they function?

Tough cash finances normally come with higher interest rates as well as much shorter payment routines. Why select a difficult money loan over a standard one?

All About Hard Money Atlanta

Additionally, since personal people or non-institutional loan providers supply tough cash lendings, they are exempt to the same policies as traditional loan providers, which make them more risky for customers. Whether a hard cash funding is read here ideal for you relies on your circumstance. Difficult cash loans are good alternatives if you were rejected a conventional funding and require non-traditional funding.

Contact the expert home loan consultants at Right Begin Home Loan to find out more. Whether you wish to acquire or re-finance your residence, we're below to aid. Get going today! Request a complimentary tailored price quote.

The application process will typically entail an evaluation of the residential property's worth and potential. That method, if you can not manage your repayments, the hard cash loan provider will simply relocate ahead with marketing the residential or commercial property to recoup its investment. Difficult money lending institutions generally bill greater passion rates than you 'd have on a typical funding, however they additionally fund their financings quicker and typically need much less paperwork.

As opposed to having 15 to three decades to pay off the car loan, you'll commonly have simply one to 5 years. Difficult cash loans function fairly differently than conventional financings so it's essential to understand their terms and also what purchases they can be made use of for. Difficult money fundings are typically planned for investment residential properties.

Comments on “Hard Money Atlanta - The Facts”